It’s a great time to be in a SaaS business. The sector’s long-term prospects are strong with SaaS revenues expected to grow by almost 10% every year to reach $344 Billion by 2027.

But even with such a positive outlook, the road is still bumpy for many founders. Many B2B SaaS businesses struggle to break even and recoup their investment.

As a B2B SaaS founder, nothing is more frustrating than this. Even with the economy in shambles, the least you expect is to earn enough revenue to meet your operational costs.

But the ground reality is that your B2B SaaS is losing money. How is that possible?

This post explores four reasons why your business might be losing money.

1. Failure to Achieve the Right Product-Market Fit

When you don’t achieve the right product-market fit for your B2B SaaS, the chances of losing money are high.

Most people assume that the main reason for B2B SaaS failure is the technology, but in most cases, it’s related to the market. When you create a product that doesn’t fit current market needs, then your SaaS business will lose money.

Take Brisk for example. The company was founded in 2012 to help salespeople analyze and predict sales. The company was getting few customers at the start, so they decided to offer custom services.

This move helped them gain many happy customers but it became costly for the organization in the long term. Brisk was reluctant to make clients pay for the extra services so as not to lose favor with customers.

For example, If pharmaceutical companies focus on the general social media platforms to promote their brand then definitely they may not get the right audience for their business. But if pharmaceutical companies focus to promote their brand on the HCP engagement platforms with the right marketing strategy and get relevant audience for their brands.

The company started losing money and eventually shut down in 2016.

2. Steep Price Tag

Good subscription management is top most feature of the SaaS business model. B2B SaaS customers make regular payments to use a product. The payments can be made weekly, monthly, or annually.

To attract and retain customers you need to set a fair price for your software. Don’t make the mistake of charging a high amount, especially when you are new to the market, or you will struggle to get customers to pay for your product.

This will see your SaaS lose money because you will not be generating enough revenue through subscriptions to meet your operational expenses.

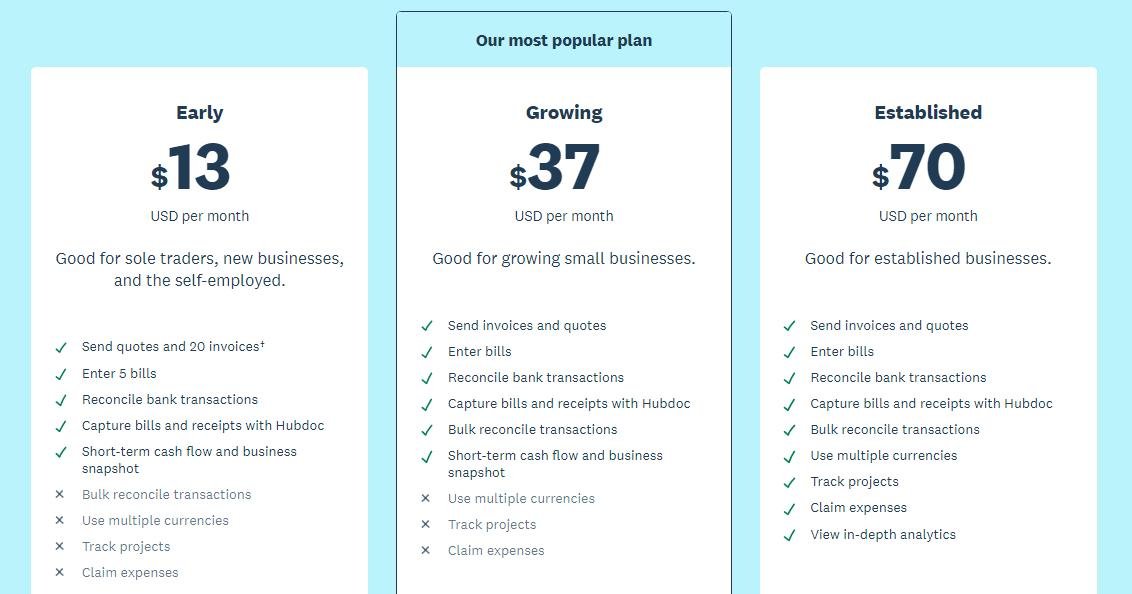

The solution to this challenge is to implement a tiered pricing strategy. Customers can start with the least expensive option and work their way up to the premium plan that gives them access to all the top features of your SaaS product.

The B2B accounting software Xero, for example, has 3 pricing plans for its customers. The most expensive plan provides the most features and is best suited to established organizations.

3. Not Providing Sufficient Pricing Information

Setting a high price tag isn’t the only pricing issue that could see you lose money. Failing to provide sufficient pricing details on your website could also be the reason why your B2B SaaS business is losing money.

Customers want to know the exact amount they will pay before starting a free trial. Hiding this information makes them think that the price of your software is out of their reach, and most may opt out of the free trial.

As per this Attrock article, if you spent a lot of money to attract quality B2B SaaS leads, and it would be such a loss to lose them just because you don’t provide sufficient pricing information.

To drive more customers down the sales funnel, ensure your price communicates the following:

- Unit price – This is the amount customers pay to access your product

- Subscription period – It indicates how long customers can use your product before their subscription expires

- Features – The features users can access in a specific pricing plan

- Additional costs – Indicate the cost of additional features and services

4. Poor UI/UX

How easy it is for customers to navigate a platform and complete tasks plays a key role in the success of a SaaS product.

If your software is difficult to use, many customers will quit before they gain maximum value from it. Considering you spent a lot of resources to develop and market the product, a poor user experience negatively affects the profitability of your SaaS business.

You also miss out on free marketing when your product has poor UI/UX. Early adopters will not want to be associated with your product and won’t promote it to their friends and colleagues.

Conclusion

Building a B2B SaaS is not easy and the last thing you want to deal with is your company losing money. If that’s the case, then we have shared a few reasons why that’s the case. Examine your operations keenly and work on the issues hindering your growth.

——————————————————————————————————————-

Author Bio – Reena Aggarwal

Reena is Director of Operations and Sales at Attrock, a result-driven digital marketing company. With 10+ years of sales and operations experience in the field of e-commerce and digital marketing, she is quite an industry expert. She is a people person and considers the human resources as the most valuable asset of a company. In her free time, you would find her spending quality time with her brilliant, almost teenage daughter and watching her grow in this digital, fast-paced era.