Jerri Lynn Dyke is in the spotlight since she is the daughter of the late legendary comedian and actor Jerry Van Dyke with his first wife, Carol Johnson. She is one of the couple’s three children. Although a successful business person, Jerri Lynn Dyke keeps a low profile. Jerri had two siblings; a brother named Ronald J Van Dyke and a sister named Kelli Jean Van Dyke. Unfortunately, her sister passed on, so she’s the only daughter alive of her parents. What caused Jerri’s sister’s death? Below is a detailed account of Jerri’s life and that of her family.

Jerri Lynn Dyke Age

Jerri Lynn Dyke is a private person who kept the details of her birth date, age, and birthday away from social platforms. She is the daughter of the late Jerry Van Dyke and his ex-wife, Carol Johnson. The couple had two daughters and a son, but unfortunately, one of them died years ago, and Jerri and her brother are the only ones alive. Despite her father’s fame, Jerri keeps from the spotlight and has shared very little about her personal life. It is unclear whether she is married and has children or not.

Jerri Lynn Dyke Career

Professionally, Jerri is a businessperson. She has amassed wealth worth $500,000 over the years from her successful businesses. However, the details of her business ventures are unclear.

Jerri Lynn Dyke Siblings

As mentioned, Jerri is not her parent’s only child, as she had two siblings. Her brother Ronald J Van Dyke has been a professional photographer and travel enthusiast for over a decade. Ronald has a daughter and a granddaughter with whom he has shared a photo on his Instagram. He has worked with famous models and actresses like Sofia Minarro, Elsa Sommarstorm, and Kate Kuhne. Ronald has a personal blog on Smug Mug, where he uploads pictures of the models he works with and those of fashion and modeling events he attends.

Jerri’s late sister Nancee Kelley was an actress and adult film performer. She was born Kelly Jean VanDyke on 5 June 1958 in Denville, Illinois, and committed suicide on 17 November 1991 in Los Angeles, California. Kelly married actor Jack Nance in May 1991, whom she had met in rehab due to their struggle with drug and alcohol addictions. She was also trying to cut connections with the porn industry, where she worked under the name Nancee Kelley. Unfortunately, she had relapsed and resumed making pornography. A conversation with her husband over the phone where he said he wanted to end their marriage led to her committing suicide.

Jerri Lynn Dyke Parents

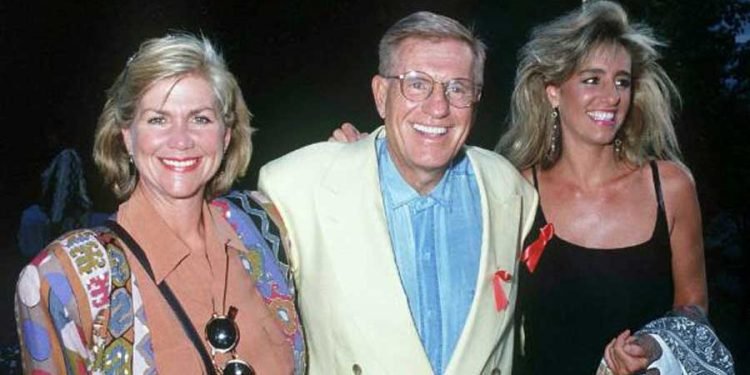

Jerri’s mother, Caroline Johnson, has kept under the radar over the years and was only famous as Jerry Can Dyke’s first wife. On the other hand, Jerry was an actor and comedian whose career spun around supportive and guest roles in television series. He was the actor Dick Van Dyke’s brother; Barry Van Dyke was his nephew, while Shane Van Dyke was his grandnephew.

Jerry’s second wife was Shirley, with whom he lived on an 800-acre ranch in Hot Spring County, Arkansas. He died of heart failure on 5 January 2018, aged 86. His health was declining due to a car accident two years earlier from which he never fully recovered.

Wrapping Up

Jerri chose not to shadow her father’s fame and became a businessperson who lives a quiet life away from the limelight.