Generating life insurance leads is essential to your success in the highly competitive insurance business world. Lead generation is the process of pinpointing and attracting prospective customers who have shown interest in your products or services. With some insurance lead generation ideas, you can learn how to find life insurance leads to increase conversion rates and boost revenue. This article will explore how to generate life insurance leads for your businesses.

1. Create High-quality Content

High-quality content will never become old-fashioned. Besides, it is another great approach to reaching out to your qualified life insurance leads and finding potential ones.

Remember that developing good content takes time, so make sure you have a strategy in place before beginning your content marketing efforts. Here are a few strategy tips for applying to your content marketing:

- Research your topic. Conduct research to determine the most relevant topics and keywords for your target audience. To uncover popular search phrases connected to life insurance, use tools like Google Keyword Planner.

- Create content. Write excellent material, such as blog posts, e-books, infographics, or informative films, to give information on the benefits of life insurance.

- Optimize your content. Include relevant keywords, meta descriptions, and headlines.

- Include a CTA. Insert a link to request a quote or schedule a consultation.

- Measure results. Track data like website traffic, engagement, and conversions to determine the success of your content.

2. Optimize Your Website

As the world gets more digital, simply having a website is no longer sufficient. You must optimize your website to make it more visible and user-friendly to get insurance leads. Website optimization is critical for generating insurance leads because it ensures potential clients can easily find it. A well-optimized website will rank higher in search engine results, increasing visibility.

Furthermore, offering a compelling user experience that motivates users to take action may help build credibility and improve conversion rates.

Here are a few ideas for optimizing your website to attract insurance leads online:

- Optimize website for mobile devices. Check that your website is responsive and adapts to multiple screen widths. Optimize your website’s loading speed, as increased loading times might result in high bounce rates.

- Use landing pages. Landing pages attract life insurance leads by addressing a specific problem or solution linked to life insurance. Make sure your landing pages have clear CTAs and are SEO-friendly.

- Monitor and analyze your website’s performance. Track your website’s traffic, bounce rates, and other analytics. Use this information to make data-driven decisions and to enhance your website consistently.

- Improve user experience. Ensure your website’s appearance is simple and the information is easy to read. Make your website visually appealing by using high-quality photographs and videos. Make sure it contains CTAs to direct users to the intended activity, such as filling out a form or contacting you.

3. Use Social Media

Social media platforms allow insurance businesses to connect with insurance leads online cost-effectively and efficiently. Using Facebook, Twitter, and LinkedIn may help you create relationships with potential consumers, offer useful content, and reach a broader audience.

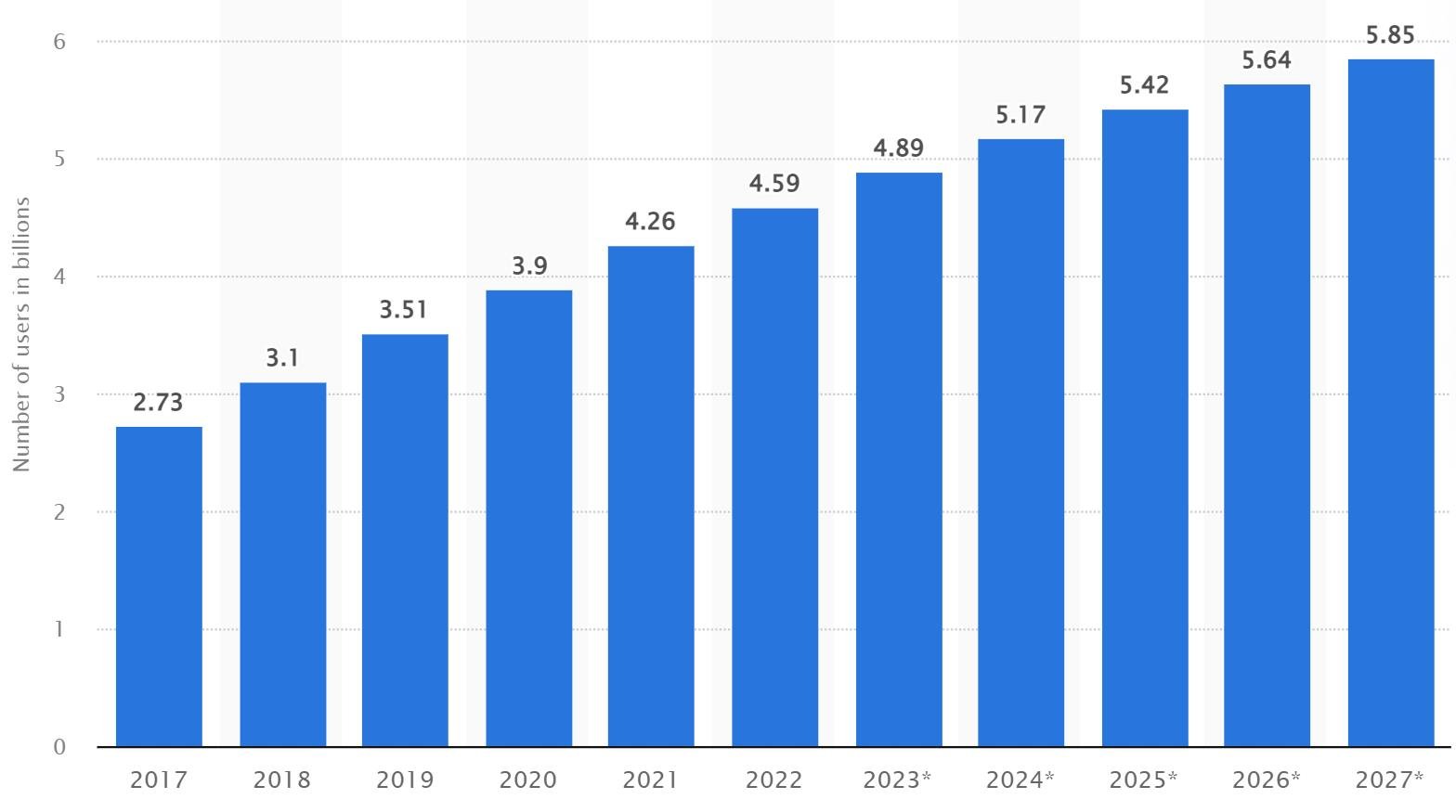

You may also use social media to provide insurance tips, such as why having coverage is crucial and how to pick the best plan. If your idea is to inform, educate, and reach out to as many users as possible, then social media is the place to be. Social networking is one of the most popular digital activities in the world, with the number of users expected to reach about six billion by 2027.

Social media lets you communicate with life insurance leads by responding to their queries and comments. You can also provide discounts or promotional deals.

4. For insurance agents

SEO (Search Engine Optimization) is a superpower that can make their business shine online. Imagine you have a shop, and people are looking for insurance nearby. Good SEO makes your shop easier to find when someone searches online. It’s like putting a big sign outside your store saying, “We’ve got the insurance you need!”

Insurance SEO is the key to making your website more visible on search engines. When someone types “insurance near me” or “best insurance for cars,” SEO helps your website pop up, catching the eyes of potential customers. This means more people discovering your services and, ultimately, more clients for your insurance business.

It’s not just about being seen; it’s also about being seen by the right people. SEO targets those actively searching for insurance, ensuring your website appears when they need it most. So, for insurance agents, embracing SEO is like unlocking a powerful tool that brings customers to your door – or, in this case, your website. It’s a smart and effective way to grow your business in today’s digital world.

Here are some tips to use on social media:

- Define your target audience;

- Choose the right social media platform;

- Use hashtags and keywords;

- Leverage paid advertising;

- Engage with your audience;

- Analyze and adjust.

1. Use Email Marketing

One of the best ways to get life insurance leads is by using email marketing. By leveraging your email list, you can reach a large audience, nurture your relationships, and build your life insurance lead lists.

To use email marketing efficiently, you need to consider the following:

- Create an email list of your target consumers and segment it by age, gender, geography, and other variables. This will help you to tailor your communications to the appropriate audience.

- Send out engaging emails with relevant info about life insurance products. Use email automation to deliver timely follow-up messages and reminders about important dates, such as policy renewals.

- Include a CTA, such as a link to book a consultation or request a quote. You may acquire more life insurance leads through email marketing by continually delivering value and creating connections.

- Track the success of your emails with analytics tools to make adjustments as needed for better results.

2. Ask for Referrals

Referrals are a great way to improve your insurance leads generation since people are more inclined to trust someone they know and have a relationship with.

To begin, contact your current life insurance leads and ask if they know anyone who could be interested in life insurance. Explain the benefits of getting life insurance.

You may also offer your qualified life insurance leads a discount on their insurance or a referral incentive for each new client they suggest. Using your existing network, you can easily expand your life insurance lead lists and enhance sales.

3. Partner With Other Businesses

Identify companies that share your target audience and offer complementary services. For example, you could collaborate with a financial counselor, a mortgage broker, or a real estate agent. By collaborating, you can reach a larger pool of potential leads for life insurance and offer a more comprehensive range of services.

Tips:

- Organize joint events. Seminars and webinars can educate potential clients about the benefits of life insurance and other associated services.

- Cross-promote. Use social media, email newsletters, or other marketing platforms to promote each other’s business.

- Offer bundled services. Offer package services that combine your services with your partner’s, such as life insurance, financial planning, and estate preparation.

Wrapping up

Lead generation for the insurance business is a critical component of success, helping to increase its customer base and grow profits. It enables them to discover and target potential consumers interested in purchasing a policy. Life insurance companies may enhance their sales and improve their business if they have a consistent supply of leads. Lead generation also assists them in determining which sorts of insurance are most popular and which marketing strategies are most effective.